Here, we will use PMT, IPMT, and PPMT financial formulas to create a car loan amortization schedule with extra payments.

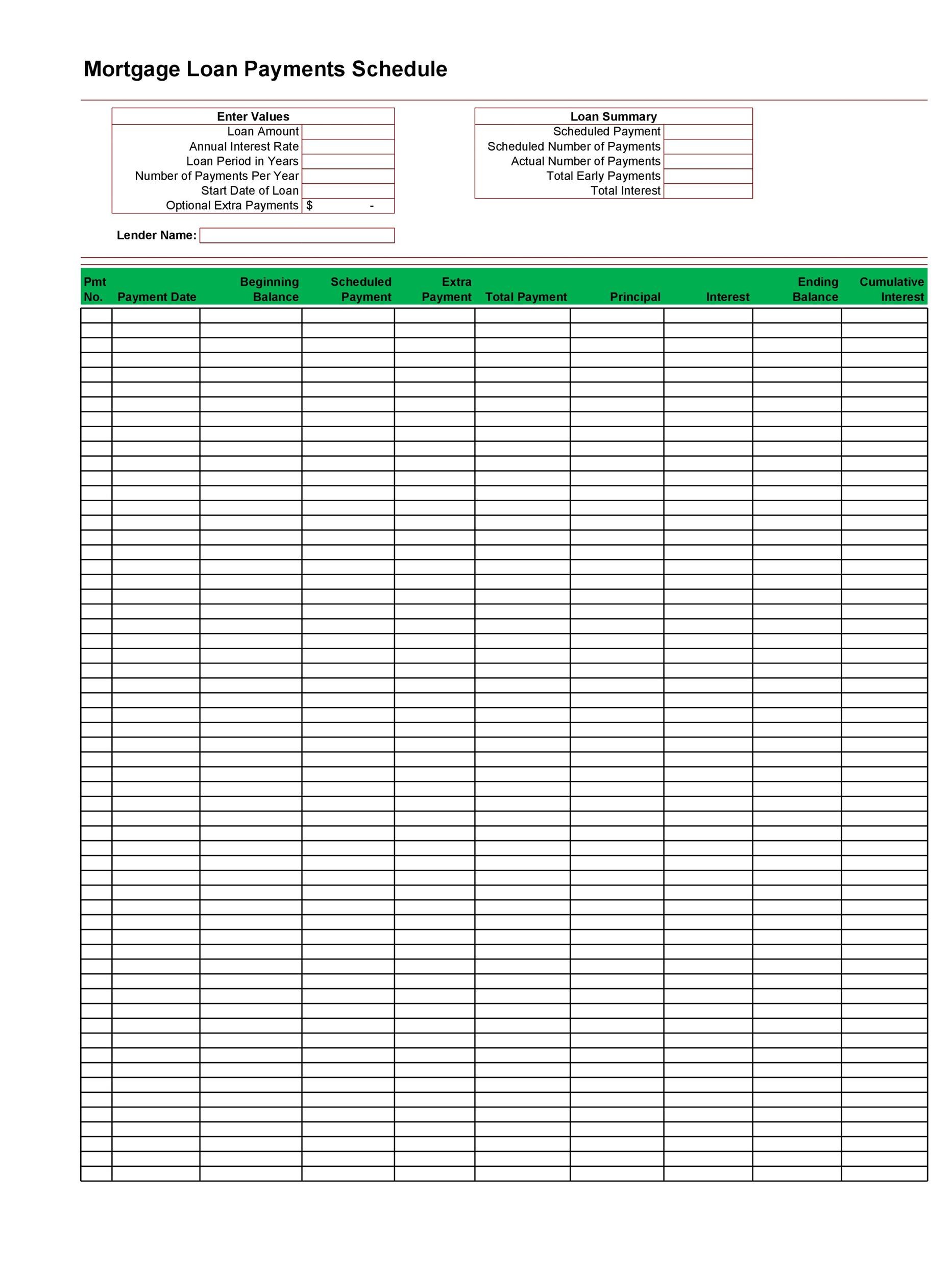

In the following section, we will use one effective and tricky method to create a car loan amortization schedule with extra payments in Excel, it is necessary to make a basic outline and calculations with formulas and calculate the final balance. Step-by-Step Procedure to Create Car Loan Amortization Schedule in Excel with Extra Payments Among the information found in the table is the number of years left to repay the loan, how much you owe, how much interest you are paying, and the initial amount owed. A Loan Amortization Schedule is a schedule showing the periods when payments are made toward the loan. Let’s say, the total value of the car is $200000.00, the annual interest rate is 10%, and you will pay the loan within 1 year. An amortizing bond, on the other hand, is one that repays a portion of the principal as well as the coupon payments. An amortizing loan is a loan where the principal is paid down throughout the life of the loan according to an amortization plan, often by equal payments, in banking and finance.

0 kommentar(er)

0 kommentar(er)